Table of Content

Another vital part of the VA appraisal is a home inspection to ensure it meets the VA minimum property requirements . The inspection, which is separate from the VA appraisal, focuses on any code violations or defects. VA home loans allow eligible borrowers to buy a home with as little as zero money down. There are plenty of individual reasons why first time home buyers don’t think they’re ready. It may not feel like a good time for some, and others are concerned about the commitment – after all, buying a home is likely the biggest purchase a first time buyer has ever made. In the current housing market, first time home buyers have a lot of reasons to be hesitant.

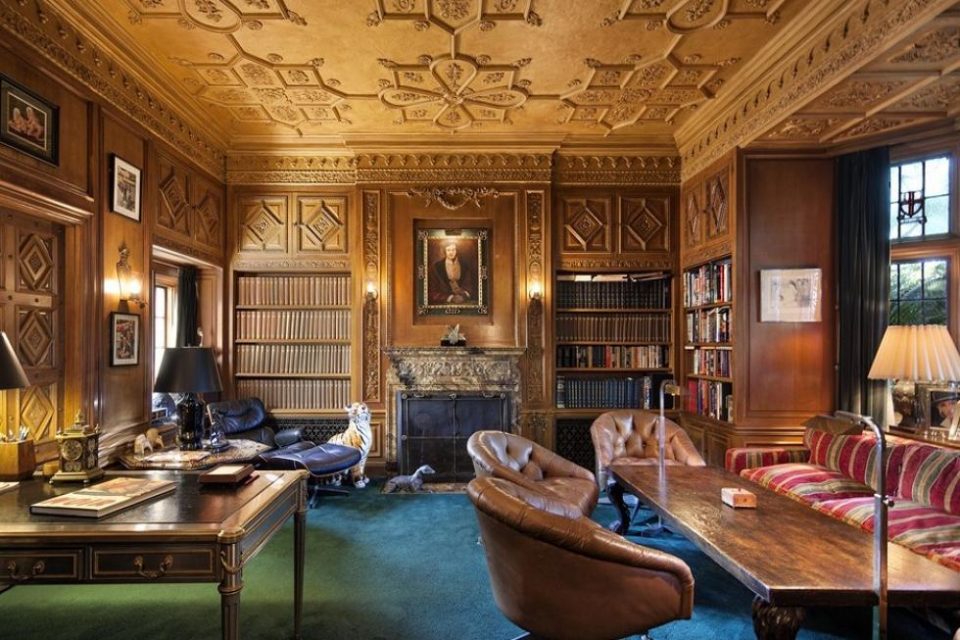

Just because it is called a VA loan does not mean that the VA offers it. This loan is available at a number of VA approved lenders and institutions, and the role of the VA here is to guarantee a part of your loan. Buying a home might seem scary but using a VA loan is perhaps the best way a first time buyer can purchase a house. Another great benefit of home buying over renting is the fact that you have the power to make home improvements as you like. You want to give your space a personalized feel reflective of you. Moreover, you can easily make changes to the house to add functionality and make it more energy-efficient.

What's the difference between a VA and FHA loan?

VA Home Loan Centers really helped me out with buying a home. I am proud to say that my family and I are the new owners of our dream home. Children in homes owned by their parents thrive much more than those in rentals, as they tend to understand the stability that their parents have provided. You will eventually have to find another place when you rent a property once the lease ends . This means you can never truly enjoy the sense of belonging that one wants to experience at some point in life.

Home buyers can choose from fixed-rate and adjustable-rate mortgages. The VA Loan is an optional no down payment mortgage for active members of the military, discharged veterans, and surviving spouses. A significant benefit of military service is the VA home loan, allowing you to purchase a home with no down payment or refinance a home. You'll still need final approval by underwriting once all documents have been received and reviewed . Many first-time homebuyers don't have enough savings for a down payment on a home purchase. And first-time homebuyers do not have proceeds from the sale of a prior home to put toward their real estate purchase.

The Home Buying Process For Veterans

FHA, by contrast, requires mortgage insurance no matter how much money you put down. For example, say you make an offer on a home for $200,000. The lender’s official appraisal report states the home is worth $205,000.

Still, some buyers might find that eligible areas are too far outside employment centers, and for that reason choose an FHA loan, which comes with no geographical restrictions. We will give you a Hero Reward® check after you close with our specialists. The average amount received by heroes we assist is $3,000. Close in as little as 17 days – with a low rate and a better payment. The VA will then allocate a local VA licensed appraiser, and within 1-2 business days the borrower will be contacted to plan a convenient time for the inspection.

What is the Difference Between a 15 Year VA Mortgage and a 30 Year VA Mortgage?

The property must meet minimum requirements set by the Department of Housing and Urban Development for an FHA loan and the Department of Veterans Affairs for a VA loan. With no down payment or mortgage insurance requirements, VA loans are hard to beat. Closings may occur at a title company, escrow office, or attorney’s office depending on your area’s laws. Expect to sign many documents including the mortgage, the note, and the deed. This can be a lengthy process but always stop to ask questions if you have any.

Every time you make a mortgage payment, a portion of that payment pays down your loan each month. USDA loans are typically regarded as being cheaper than FHA loans. USDA loans have no down payment requirements and lower mortgage insurance premiums. The key thing to remember is that many lenders offer all three types of mortgage loans.

$0 Down Payment

Buyers will find that some entire states are USDA-eligible. Even highly populated states contain surprisingly vast qualifying areas. An estimated 97% of the American landscape is geographically eligible for a USDA loan. The USDA loan has quickly risen in popularity with first-time and lower-income borrowers thanks to its zero-down allowance and low rates.

The average 30-year fixed rate for VA loans that closed in November 2020 was 2.72%, compared to 2.99% for FHA loans, according to Ellie Mae. The maximum debt-to-income ratio for FHA loans is generally 50%, although the threshold may be lower, depending on your credit score or other factors. An FHA loan might be an option for a veteran or service member with a lower credit score. A real estate agent can help you navigate the home buying process.

As a first-time homebuyer, you have many options when it comes to purchasing your home - including homes in high-cost areas. This free VA Home Loan calculator gives you a snapshot of what your monthly payments could be with a VA Loan. Another type of mortgage with the benefit of no down payment is the U.S. And, while you may be able to get approved with a 60% ratio, 41% or lower is usually preferred. The fact that you can buy a home with zero down, and have no mortgage insurance, makes VA loans tough to beat. As you begin your home buying adventure, you’ll find a number of home loan options.

This pushes monthly payments lower, making it easier to afford a home with student loans or other debt. With FHA, the home buyer must come up with a 3.5% down payment plus closing costs. FHA has no guideline stating that the loan amount can exceed the purchase price.

The Rural Development loan was created to spur homeownership in rural areas, especially among low-income and moderate-income home buyers who might not otherwise qualify. Maximums are set at 115% of the median income for your county or area. The following are examples of maximum household incomes in various locales around the country. However, the main downside with both programs is that you’ll pay ongoing mortgage insurance fees that cannot be canceled.

That’s why we pair you with a real estate specialist right off the bat. Once you sign up to speak with our local specialists, we connect you to a real estate agent who is committed to helping you pursue home ownership. They have joined our network to assist heroes like you and save you some money in the process. You could apply your VA benefits toward refinancing your house and get your monthly mortgage payment down where you want it. And because the VA refi process is usually faster than a conventional, you can stat saving in as little as 3-4 weeks.

VA Loans Center

All three kinds of mortgage insurance protect the lender in case of foreclosure. USDA’s mortgage insurance rates are typically the cheapest of the three. USDA publishes online maps buyers can use to check the eligibility of a certain address or geographical area.

If you’re a military first time home buyer and you’re ready to begin the home buying process, Homes for Heroes and our local specialists are ready to assist. When heroes work with our local affiliates to buy, sell, both buy and sell a home, or to refinance a mortgage they receive an average of $3,000 given back after closing. With pre-approval, you can make an offer on a home quickly with the help of your real estate specialist. Being pre-approved for a mortgage tells sellers that your lender agrees that you can afford a certain price point for a home.